Europe’s Heat Pump Market Booms Amid Policy Support and Surging Demand

Europe’s Heat Pump Market Surges as Policies and Energy Transition Drive Adoption

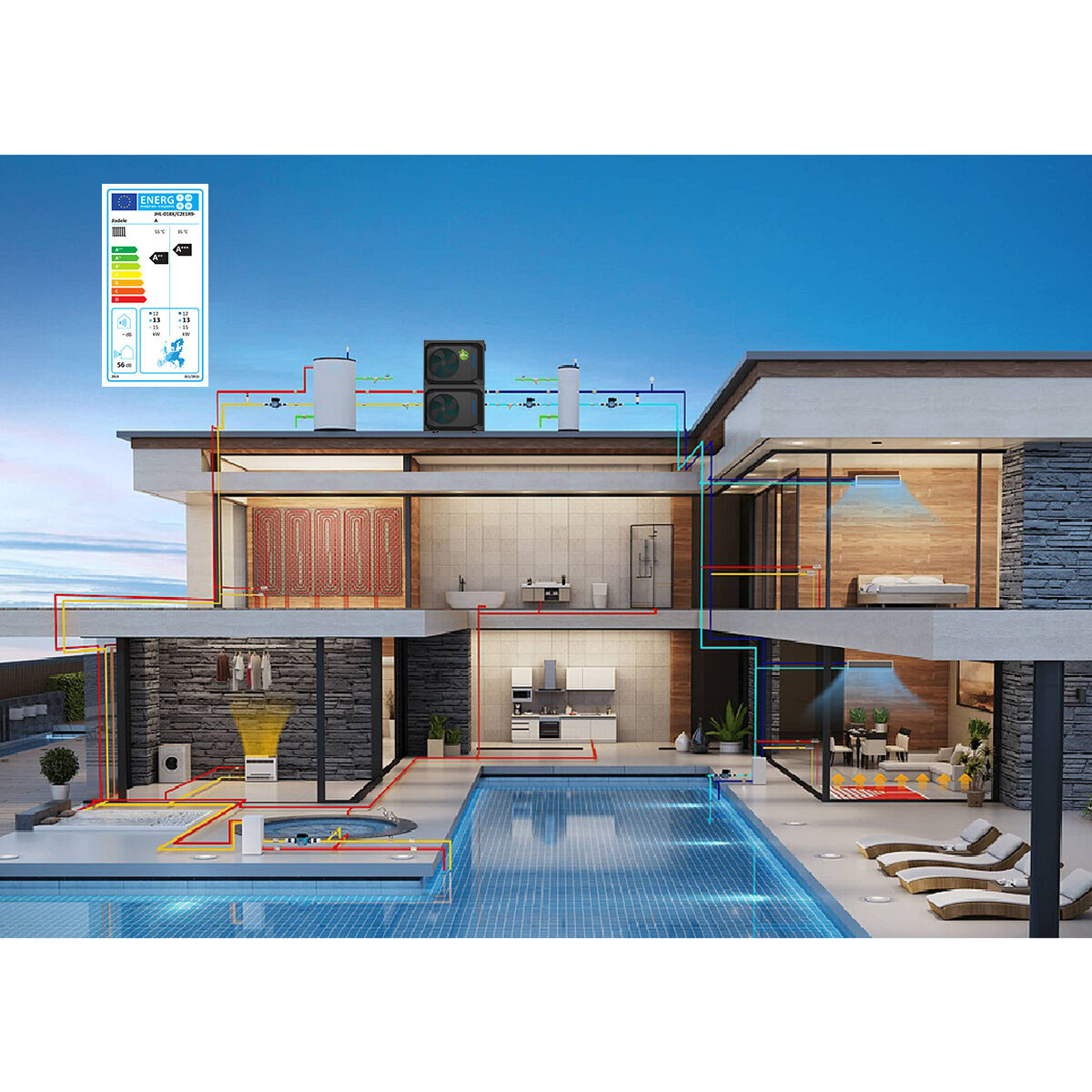

Brussels, [Date] 2024 – Europe’s heat pump market is experiencing exponential growth, fueled by decarbonization goals and policy incentives. Data shows China’s heat pump exports to Europe jumped 35% YoY in Q1 2024, with Germany, Italy, and Poland as top destinations.

Policy Push: EU Targets 60 Million Heat Pumps by 2030

The revised EU Renewable Energy Directive (RED III) now classifies heat pumps as renewable energy systems, with a goal to install 60 million units by 2030.

Germany increased subsidies to 50% of installation costs (up from 30%), accelerating residential adoption.

France and the Netherlands introduced tax credits for commercial heat pump projects.

Market Trends: Soaring Demand Meets Supply Chain Momentum

Europe’s energy crisis and gas price volatility pushed 2023 heat pump sales to 3 million units (+25% YoY).

Chinese manufacturers (e.g., Gree, Midea) are expanding market share, with some order backlogs extending into 2025.

Challenges: Skilled Labor Shortages and Cost Barriers

Europe faces a shortage of 200,000 trained installers, per German Heat Pump Association.

High upfront costs (30-50% more than gas boilers) remain a hurdle despite long-term savings.

Outlook: Analysts project Europe’s heat pump market to exceed €15 billion in 2024, with competition focusing on low-temperature efficiency and smart controls.

EN

EN

AR

AR

BG

BG

HR

HR

CS

CS

DA

DA

NL

NL

FI

FI

FR

FR

DE

DE

EL

EL

HI

HI

IT

IT

JA

JA

KO

KO

NO

NO

PL

PL

PT

PT

RO

RO

RU

RU

ES

ES

SV

SV

ID

ID

LV

LV

LT

LT

SR

SR

SK

SK

SL

SL

UK

UK

VI

VI

SQ

SQ

ET

ET

HU

HU

TH

TH

TR

TR

MS

MS

HY

HY

HA

HA

LO

LO

MY

MY